OBLIGATIONS VIS-À-VIS CUSTOMERS

“Financial institutions should be prohibited from keeping anonymous accounts or accounts in obviously fictitious names”. Thus, professionals are obliged to take due diligence measures vis-à-vis their customers in certain clearly defined situations, in particular:

(i) when establishing business relations;

(ii) when carrying out occasional transactions (subject to conditions);

(iii) where there is a suspicion of money laundering or terrorist financing;

(iv) where there is any doubt about the veracity or adequacy of previously obtained customer identification data.

The professional must identify and verify, in particular, the identity of its customer and that of the beneficial owner, including legal persons and legal arrangements, obtain information on the purpose and intended nature of the business relationship and conduct ongoing due diligence with regard to that relationship.

The identification operation consists in possessing the name and identity of the customer. Thus, the identification can be done by the fact of completing a form requesting entry into a business relationship and indicating on that form the number of an identity document.

“The verification operation, for its part, consists in making the link between the information provided and the reality of the situation by making sure that the identity stated does indeed relate to the person with whom one is dealing, that that person really exists and that the documents, data and information are respectively reliable and probative.” ref. T. POULIQUEN, La lutte contre le blanchiment d’argent, Promoculture-Larcier 2014, p. 250.

WHAT DOES THE DUE DILIGENCE OBLIGATION CONSIST OF?

“Customer due diligence measures shall comprise

- identifying the customer and verifying the customer’s identity on the basis of documents, data or information obtained from a reliable and independent source including, where applicable, electronic identification means and trust services provided for in Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions within the internal market (…), or any other secure, electronic or remote identification process, regulated, recognized, approved or accepted by the national authorities concerned;

- identifying (…) the beneficial owner and taking reasonable measures to verify his identity, using information or data obtained from a reliable and independent source, so that the professionals are satisfied that they know who the beneficial owner is, including, as regards legal persons, fiducies, trusts, companies, foundations and similar legal arrangements, taking reasonable measures to understand the ownership and control structure of the customer; (…)

- assessing and understanding of the purpose and intended nature of the business relationship and, as appropriate, obtaining information on the purpose and intended nature of the business relationship;

- conducting ongoing due diligence with regard to the business relationship, including scrutiny of transactions undertaken throughout the course of that relationship to ensure that the transactions being conducted are consistent with the professional’s knowledge of the customer, the business and risk profile, and by ensuring that documents, data or information used in the exercise of customer due diligence remain up-to-date and relevant. To this end, the professionals examine the existing elements, and this in particular for the categories of customers presenting the higher risks ”.

Section 1. Customer due diligence measures

WHEN IS DUE DILIGENCE TO BE EXERCISED?

Professionals shall apply customer due diligence measures in the following cases:

a) when establishing a business relationship;

b) when carrying out an occasional transaction that:

-

- amounts to EUR 15 000 or more, whether this transaction is carried out in a single operation or in several operations which appear to be linked; or

- constitutes a transfer of funds, as defined in Article 3, point (9) of Regulation (EU) 2015/847 (…), exceeding EUR 1 000.

“The threshold of EUR 1,000 (…) is also applicable to occasional transactions by virtual asset service providers.”

There exists no definition in Luxembourg law of the terms “occasional transaction” or “occasional customer”.

WHAT TO DO?

The ABBL recommends that professionals should refer to the following definitions:

“An occasional customer is a passing customer who requests the intervention of a financial organisation for the carrying-out of an isolated operation or a series of linked operations (…).”

“(…) where a person hands over cash to a financial organisation with a view to its being paid into an account of one of the latter’s customers, and that person has not been mandated by that customer to act on his or her account, the person in question shall be regarded as an occasional customer. The organisation shall identify that person and verify his or her identity, save where it is already in a business relationship with that person.”

“(…) a person shall be deemed to be an occasional customer where he or she approaches (a professional subject to supervision) exclusively with a view to preparing or carrying out a one-off operation or obtaining assistance in the preparation or carrying-out of such an operation, whether the same is carried out in a single transaction or in a series of apparently linked operations.”

The professional must carry out the due diligence measures prescribed in relation to “occasional customers” or customers carrying out an occasional transaction, in accordance with the risk(s) identified.

(…)

c) when there is a suspicion of money laundering or terrorist financing, regardless of any derogation, exemption or threshold;

d) when there are doubts about the veracity or adequacy of previously obtained customer identification data.”

Professionals are required to apply the customer due diligence procedures not only to all new customers but also, “at appropriate times”, to existing customers based on their risk assessment, taking into account the existence and timing of previous customer due diligence procedures, or when the relevant elements of a client’s situation change or when the professional, during the calendar year under review, is required, due to a legal obligation, to contact the client in order to review any relevant information in relation to the beneficial owner(s) or if this obligation fell to the professional pursuant to the amended law of 18 December 2015 on the Common Reporting Standard (CRS)”.

The definition of “appropriate times based on risk assessment” is given in the Grand Ducal Regulation of 1 February 2010 as amended.

“This includes one of the following situations:

“- a significant transaction occurs ;

-the standards relating to customer identification documents change substantially;

in the field of banking, a significant change occurs in the way a client’s account operates; – the professional becomes aware of a change in the way a client’s account is managed

-the trader becomes aware that he does not have adequate information about a client.

Professionals must be able to demonstrate to the supervisory authorities or self-regulatory bodies that the extent and frequency of customer due diligence measures are appropriate in view of the risks of money laundering and terrorist financing”.

Subsection 1. The acceptance process

1. Policy for accepting new customers

The notion of entering into contact with a customer covers all possible forms of contact, including conversations taking place within the bank’s premises, correspondence by post, telephone calls and exchanges by electronic means (for example the internet).

Mere requests for information which are not followed up by the prospective customer are not to be regarded as an entry into contact.

By contrast, the pre-contractual phase, which begins with an exchange of information and is characterised by the commencement of negotiations concerning the conditions for entering into a business relationship, is to be defined as an “entry into contact”.

1.1 Implementation of the appropriate procedures

“Professionals shall decide on and put in place a customer acceptance policy which is adapted to the activities they carry out, so that the entry into business relationship with customers may be submitted to a prior identification, assessment and understanding of risks (…)”.

The customer acceptance procedure must, in concrete terms, take the form of an analysis of the risk factors carried out in advance by the professional concerned, since the risks concerning the business relationship or the transaction will (or may not) result in the conclusion of the proposed business relationship/transaction.

1.2 Anticipatory nature of the identification and of verification of identity process

Professionals are required to formalise the procedure for identifying prospective customers/customers (natural/legal persons) in their “KYC: Know your customer” documents.

The identification of the customer/beneficial owner forms only a part of the “KYC” procedure, which contains a plethora of crucial supplementary information for assessing the attendant risks and proceeding, where appropriate, with the entry into a business relationship.

“The customer acceptance policy shall require the documentation of all contact, no matter in which form, and shall notably envisage a customer questionnaire adapted to the nature of the contact and the business relationship. When entering into a new business relationship with a company or other legal entity, a trust or a legal arrangement with a structure or functions similar to those of a trust for information on beneficial owners should be registered under Article 30 or 31 of Directive (EU) 2015/849, professionals collect proof of registration or an extract from the register ”.

“The verification of the identity of the customer and of the beneficial owner shall take place before the establishment of a business relationship or the carrying-out of the transaction.”

“However, the verification of the identity of the customer and the beneficial owner may be completed during the establishment of a business relationship if this is necessary in order not to interrupt the normal conduct of business and where there is little risk of money laundering or terrorist financing occurring. In such situations these procedures shall be completed as soon as practicable after the initial contact and professionals take measures to effectively manage the risk of money laundering and terrorist financing ”.

“(…) Professionals can enter into a business relationship, open a customer account or carry out a transaction for an occasional customer before or while the identity of the customer and the beneficial owner is verified (…) provided that the following conditions are met:

- the risk of money laundering and terrorist financing is low and managed effectively;

- it is necessary not to interrupt the normal course of business;

- identity verification is carried out as soon as possible after the first contact with the customer. The impossibility of verifying the identity of the client and the beneficiary within the time limit prescribed by internal rules must be the subject of an internal report which will be sent to the control manager for the required purposes

- sufficient measures are in place so that no outflow of assets from the account can be made before the completion of the verification check

(…)”

It may be “permissible for verification to be completed after the establishment of the business relationship, because it would be essential not to interrupt the normal conduct of business”, for example in the case of:

- “non face-to-face business”;

- “securities transactions. In the securities industry, companies and intermediaries may be required to perform transactions very rapidly, according to the market conditions at the time the customer is contacting them, and the performance of the transaction may be required before verification of identity is completed.”

1.3 The Acceptance Committee or “written authorisation from a specifically appointed superior or body”

“(…) The acceptance of a new customer shall be submitted to a superior or to a specifically appointed professional body for written authorisation by providing for an adequate hierarchical decision-making level, and for customers with a higher level of risk, at least the systematic intervention of the compliance officer”.

“The acceptance of a new client with a low ML / FT risk, following the risk-based approach as implemented by the professional, can be carried out on the basis of an automated acceptance process. ‘not involving the intervention of a natural person on the professional’s side, so as to constitute an effective and reliable alternative to validation by a natural person of the professional.

This process must have been configured and professionally tested beforehand and regularly through the analysis of its robustness. This process must be in line with the professional’s AML / CFT policies and procedures and the instructions to be issued by the CSSF ”.

In accordance with current practice, an examination by a so-called new business relationships committee (or “acceptance committee”) is recommended, particularly in certain cases requiring the authorisation of an executive, but also depending on the nature of the relationships or persons concerned. Not all account openings need to be referred to the new business relationships committee, but it must be called upon to examine at least those which meet certain criteria, particularly those involving a degree of risk. The determination of the risk level must take into account, in particular, the risk factors set out above in Chapter 1 of Part II (“Identification and assessment of risks”) of this Vade Mecum.

It is recommended that responsibility for the entry into a business relationship should not lie with a single person and that the new business relationships committee should be composed of persons from different departments within the professional’s organisation (for example the executive management, the sales and marketing department, the legal department, the compliance officer, etc.).

As regards risky customers, the requirements relating to documentary evidence, particularly documents proving the origin of funds, are more stringent. The quantity and quality of the information (supporting documents) required in relation to the customer and the beneficial owner must likewise meet a high standard.

For clients who present a low risk in terms of money laundering, CSSF Regulation No. 20-05 of 14 August 2020 introduces the possibility of using an automated acceptance system that does not require human intervention. This formalizes a market practice, at least encouraging the system when the risk of money laundering is low and given the increasing digitalisation of services.

1.4 Questionnaire concerning entry into a business relationship

“The customer acceptance policy shall require the documentation of all contact, no matter in which form, and shall notably envisage a customer questionnaire adapted to the nature of the contact and the business relationship.”

The customer acceptance policy shall also provide for procedures to be followed when there is a suspicion or reasonable grounds for suspicion of money laundering, an associated predicate offense or terrorist financing in case contact with a possible customer fails. The reasons for a customer or professional to refuse to enter into a business relationship or to execute a transaction shall be documented and kept (in accordance with the terms of CSSF regulation no.12-02), even if the professional’s refusal does not ensue from the observation of a money laundering or terrorist financing indication.”

2. Identification of customers and verification of their identity

The customer must be identified, and his/her identity verified, on the basis of documents, data or information emanating from a reliable and independent source, including, where applicable, electronic identification means and relevant trust services provided for in Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and services of trust for electronic transactions within the internal market (…) ” or any other secure, electronic or remote identification process, regulated, recognized, approved or accepted by the national authorities concerned”..

2.1 Customers who are natural persons

2.1.1 The account-holder

“For the purposes of the identification of customers pursuant to Article 3 paragraph 2, subparagraph 1, point a) and subparagraph 2 of the Law, the professionals shall gather and register at least the following information:

- surname(s) and first name(s);

- place and date of birth;

- nationality (-ies);

- full address of the customer’s main residence;

- where appropriate, the official national identification number.”

“The information listed in point 1 above is to be collected and recorded also for the initiators, the promoters who are at the basis of the launch of an investment fund under the supervision of the CSSF who will be the professional’s client” .

Verification of the identity of a customer who is a natural person

(1) “The verification of the identity, within the meaning of Article 3(2)(1)(a) of the Law, of customers who are natural persons shall be made at least with one valid authentic identification document issued by a public authority and which bears the customer’s signature and picture such as, for instance, the customer’s passport, his ID , (…) his residence permit, his driving license or any other similar document.”

“Electronic identification means, including the relevant trust services provided for by Regulation (EU) No. 910/2014 or any other secure, electronic or remote identification process, regulated, recognized, approved or accepted by the national authorities concerned may be used by the trader to fulfill his obligation of vigilance referred to in Article 3 (2), subparagraph 1, point a) of the Law ”.

(2) “According to the risk assessment, and without prejudice to other enhanced due diligence obligations,the professionals shall take additional verification measures such as, for example, the verification of the address indicated by the customer through the proof of address or by contacting the customer, among others, per registered letter with acknowledgement of receipt.”

See the tables contained in Annex V “Documents” relating to the due diligence obligations with regard to customers who are natural persons.

The practice regarding documentary requirements may vary from one establishment to the next, and may sometimes be more restrictive than the regulatory requirements. The legislative and regulatory framework in Luxembourg allows professionals, in appropriate circumstances, a certain discretion as regards the choice of the documentation to be used for the purposes of identifying a customer who is a natural person.

Thus, the professional may usefully refer to the recommendations/good practices concerning the identification of customers published by professional associations (e.g. ALCO, IRE) or by the supervisory authorities for the banking/financial sector or others (AED).

Exceptional situations:

Some customers may also hold specific documents (e.g. a “carte de forain” (travelling showman’s card), “carte de séjour” (residence permit), “livret de famille” (family record book), etc.), assessment of the relevance of which is left to the discretion of the professional, but which do not in themselves provide complete identification. In such situations, it is appropriate, as indicated above, to obtain other documents emanating from a reliable and independent source which supplement the documents of a specific nature provided by the customer.

Where an official identity document does not contain a signature, the professional must demand an additional supporting document. A clear link must be established between the identity of the customer and his/her signature. The additional supporting document must, in such cases or in an exceptional situation, contain the requisite confirmatory information with regard to the identification of the customer.

A few examples of possible supplementary documentation requirements regarding customers who are natural persons:

– Document of title proving ownership of the principal residence, rent receipt less than three months old, home insurance certificate, documents evidencing liability to pay housing tax, property tax, municipal taxes, official document showing entitlement to subsidies from the State;

– Certificate of nationality, naturalisation certificate, veteran’s card, movement card issued by the military authorities, invalidity card;

– Internet/mobile telephone invoices less than three months old (on paper or in dematerialised form);

– Most recent notice of assessment/non-assessment to tax, pay slips indicating the principal residence, official pension document indicating the principal residence, official grant of a tax credit, various State allowances (family allowances, invalidity allowances, etc.);

– Administrative summons, formal notice to pay or perform, process served by a bailiff/process server, etc.

A driving licence may also constitute an official document proving the customer’s identity or supplementing other documents in the customer’s file, especially for customers residing in third countries.

A few examples of various situations:

- In order to be able to deal with the documentary evidence efficiently, it is current practice systematically to take copies of ID documents.

- Professionals must pay special attention to unusual situations, such as the absence or temporary nature of the place of residence of a customer (for example, a suite in an hotel, a post office box, etc.). Professionals must check to ensure consistency between all the items of information received by them regarding the identification details. Where there is any inconsistency (for example as to the address) or insufficient information, the provision of additional supporting documents must be requested.

Entry into a business relationship may only be agreed to by a professional if the latter is in possession of all the documents which it has asked its customer to provide.

2.1.2 The authorised agent/attorney of a customer who is a natural person lacking legal capacity or a minor

The powers of representation of the legal representatives of customers who are natural persons lacking legal capacity, i.e. who are the subject of guardianship/supervision measures (or analogous measures), or minors, must be verified by means of documents evidencing the situation.

The identification and verification of the identity of the customer’s authorised agent/attorney must, in addition, be done in the manner described in point 2.1.1. The professional must take copies of the documents provided.

A “livret de famille” (family record book) is sometimes used in the case of the opening of an account in the name of a minor by a person of full age. In such cases, the identity of the latter must be verified, together with the link between that person and the minor.

It is recommended that a copy of the minor’s identity document be obtained, if he/she possesses one, and by no later than the time when he/she reaches full age. Generally, it is recommended that professionals ask the customer to inform them of any change occurring in the customer’s legal status.

2.1.3 The particular case of the status of a refugee or an AIP (applicant for international protection)

Although attestation of the lodging of an application for international protection constitutes only part of the verification of the identity of a customer within the meaning of the Law, it will be noted that this bears the stamp of the Ministry of Foreign Affairs as well as the signature of an official within that Ministry, together with the ID photograph of the applicant for protection, his/her signature and ID indications as required by Article 16 of CSSF Regulation No 12-02.

Subject to its being valid, such an attestation may be regarded as acceptable for the purposes of opening a bank account in Luxembourg offering basic financial services, on condition that the risks resulting therefrom are mitigated by the terms and conditions of use of that account and the application of enhanced due diligence measures in the particular cases concerned.

Banks should also monitor the behaviour of the applicant for asylum in terms of the nature, amount, origin/purpose of the transaction concerned, etc. so as to be able to spot potentially suspicious transactions and to intervene in an adequate manner, where necessary in accordance with Article 5(1)(a) of the Law.

Banks should regularly review the risk profile of the applicant for asylum in question, with a view to checking that his/her profile is still appropriate, in particular after several months have elapsed, in order to verify any development in the status of the person concerned.

Banks should also reject a request for the opening of a bank account offering basic services where the opening of such an account would entail a breach of the provisions applicable in relation to the prevention of money laundering and the combatting of terrorist financing.

It is suggested that any request for the opening of an account by or for an applicant for international protection, or any identity check carried out in the context of a banking transaction, should be dealt with on the basis of a document fulfilling the following characteristics:

1 – Statement of the main ID information details prescribed by Article 16 of CSSF Regulation No 12-02 (bearing in mind that it is not mandatory to state the address), AND

2 – Presence of an ID photograph of the applicant for protection, AND

3 – Presence on the document of a stamp of the Ministry of Foreign Affairs or of the OLAI (Luxembourg Reception and Integration Agency), OR

4 – Presence on the document of a signature of a representative of the Ministry of Foreign Affairs or of the OLAI.

Any documentation not including all of the characteristics set out above will be accepted by the professional at its own risk, it being understood that an exception may be made as regards any attestation of the lodging of an application for international protection which bears a stamp or the words “Rejected” or “Annulled”, but only provided the following conditions are fulfilled:

– the acceptance of such an attestation (bearing the stamp or the words “Rejected” or “Annulled”) is permissible only for the identification of the applicant for international protection in the context of transactions carried out on or from an account (and not for the opening of that account);

– as long as the account of the applicant for international protection records the crediting of sums coming from the Ministry of Foreign Affairs and/or the OLAI.

The absence of payments coming from those authorities may mean that the application has been rejected and warrant further research/checks on the part of the establishment concerned.

2.1.4 The validity of a French identity card which expired less than 5 years ago

Under the French rules, since 1 January 2014, the duration of the validity of the national identity card has been extended from 10 to 15 years for persons of full age (aged over 18). The five-year extension for identity cards concerns:

- new secure identity cards (plastic cards) issued as from 1 January 2014 to persons of full age;

- secure identity cards (plastic cards) issued between 2 January 2004 and 31 December 2013 to persons of full age.

If the identity card was issued between 2 January 2004 and 31 December 2013, the five-year extension of the validity of the card is automatic. The validity date appearing on the document will not be changed. For cards that appear on their face to have expired but the validity of which has been extended for 5 years, the Luxembourg State has officially confirmed that these will be accepted by it as travel documents.

A French national may validly use the above-mentioned French identity card, appearing on its face to have expired but still valid in consequence of its having been extended for a further 5 years following an initial issue/validity period of 10 years, in the context of entering into a business relationship with a credit institution.

The professional must determine, in its discretion and applying a risk-based approach, whether to accept a French identity card that has expired, and must, where necessary, request other documentary evidence relating to the identification of its customer.

2.1.5 Electronic means of identification and of verifying the customer’s identity

A. The due diligence measures in relation to customers include the following:

“identifying the customer and verifying the customer’s identity on the basis of documents, data or information obtained from reliable and independent sources, including, where available, electronic identification means, relevant trust services as set out in Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services (…), or any other secure, remote or electronic identification process regulated, recognised, approved or accepted by the relevant national authorities”.

Professionals may have recourse to video conferencing by using a software developed by themselves or by an external supplier, or may delegate that “on-boarding” video function to a third party. Only a natural person trained for that purpose may use the video conferencing system and deal directly with the prospective customer, thereby de facto excluding the sole intervention of a robot without any additional safeguards.

Only natural persons (the customer, the customer’s statutory representative or authorised agent/attorney, a co-holder of the account or a beneficial owner) may use the function and be identified by the professional.

The video conferencing tool may only be used if the professional has no suspicion of any money laundering/terrorist financing and there can be no dispute as to the veracity and relevance of the documents submitted in advance by the customer.

During the identification of the customer, the data appearing on the identity documents must be clearly legible and clearly identifiable (good lighting conditions, the customer must not be disguised or wearing any headgear that covers part of his or her face, etc.). Only official identity documents emanating from the issuing country and containing optical security devices (holograms, special printing features, etc.) are authorised for the verification procedure. Annex V of the Vademecum contains a convenient link to the online public register of authentic identity and travel documents for citizens worldwide, as established by the Council of the European Union.

The professional must guarantee the efficacy and reliability of the system and remains at all times answerable for compliance with the due diligence obligations incumbent on it in relation to its customers.

WHAT TO DO?

Professionals wishing to make use of video facilities/systems to the purposes of onboarding customers remotely shall get in touch with the CSSF to describe the systems they intend to operate. The CSSF may come with useful comments, which should be duly taken into consideration before making use of the system.

The opinion of the Joint Committee explores, in particular, the ways in which the innovative solutions currently used by financial sector professionals can help them to better fulfil their AML/CFT obligations. For example, the solutions involving non-face-to-face verification of the identity of customers may contain special functionalities making it possible to determine whether the identity document produced really belongs to the person producing it, by combining a number of parameters such as, in particular, biometric facial recognition, document security features and optical character recognition.

Those innovations can also considerably improve the transaction monitoring processes of credit and financial institutions by automating them and making it possible instantaneously to extract relevant data from a number of different databases.

At the national level, as regards the interoperability/cross-border use of trust services supplied by “trust services providers” as defined in Regulation (EU) No 910/2014 and consisting notably in the creation, verification and validation of electronic signatures, electronic seals (…), electronic registered delivery services and certificates related to those services, the Luxembourg portal “qualité.lu” of ILNAS (the national control body) produces the Luxembourg list of such trust service providers (that is to say, in practice, LuxTrust).

At the European level, the European Commission likewise publishes a list of trust service providers.

The customer’s identity must be verified by the professional by means of real-time audio-visual communication, making sure that appropriate technical media are used. The professional must take care to check the authenticity of the customer’s ID documents, in particular via the reading and decryption of the optical security devices contained in the documents supplied by the customer and other elements chosen by the professional.

Under Regulation (EU) No 910/2014, since 1 July 2016:

“1. An electronic signature shall not be denied legal effect and admissibility as evidence in legal proceedings solely on the grounds that it is in an electronic form or that it does not meet the requirements for qualified electronic signatures.

2. A qualified electronic signature shall have the equivalent legal effect of a handwritten signature.

3. A qualified electronic signature based on a qualified certificate issued in one Member State shall be recognised as a qualified electronic signature in all other Member States.”

In addition, the legal value attaching to an electronic signature is stated in the Civil Code:

“The signature required for the perfection of a private document shall identify the person appending it and shall manifest his/her willingness to adhere to the content of the document. It may be in manuscript or electronic form.”

B. Specific measures to be adopted by the trader in the case of a non-face-to-face business relationship

“Where the client is not physically present or has not been met by or on behalf of the trader for the purpose of identification, a so-called “non-face-to-face” relationship, and the trader has not taken the necessary guarantees as set out in Annex IV, point 2) c) of the Law (i.e. not accompanied by guarantees such as electronic means of identification within the meaning of Regulation (EU) No 910/2014 or any other secure electronic or remote identification process regulated, recognised, approved or accepted by the relevant national authorities) specific measures must be applied by the trader to compensate for the potentially higher risk presented by this type of relationship”.

The specific measures to be taken in this case may include

“measures to ensure that the identity of the client is established by means of additional documents, data or identifying information

additional measures ensuring verification or certification by a public authority of the documents provided

a confirmation statement from a credit or financial institution subject to the Act or subject to equivalent professional obligations in relation to AML/CFT

measures to ensure that the first payment of transactions is made through an account opened in the customer’s name with a credit or financial institution subject to the Act or subject to equivalent professional anti-money laundering and anti-terrorist financing requirements.

This list of additional measures to be adopted in case of entering into a business relationship at a distance and in the absence of the necessary guarantees as referred to in particular in Regulation (EU) n°910/2014 was introduced by CSSF Regulation n°20-05 and is not exhaustive. The professional is free to adopt other measures that he deems useful.

2.1.6 FATF Guidance on digital identity

Digital ID simply refers to the use of technology in asserting and proving identity.

Section III of the Guidance is the most relevant one as pertaining to standards regarding customer due diligence standards. Overall, the guidance should help professionals understand if a digital ID is fit for customer due diligence purposes, having firstly understood the attributes of a digital ID systems.

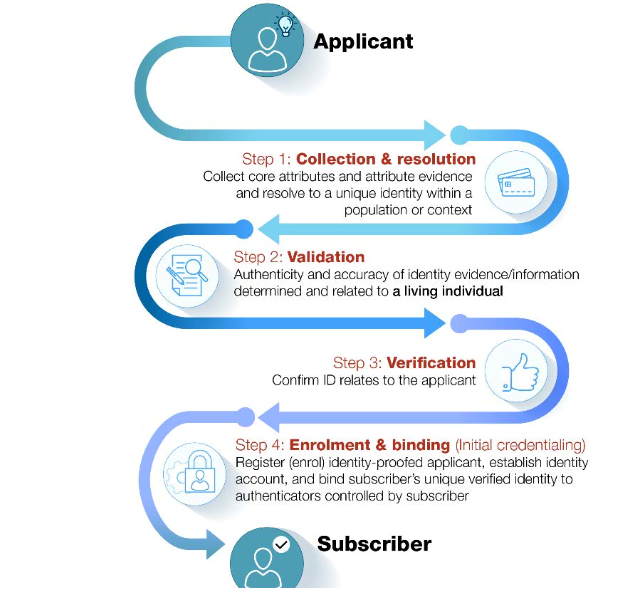

A. Briefly summarising the digital ID process (appendix A of the FATF guidance)

As shown above, the digital ID process mostly entails two components:

- Identity proofing and enrolment

The firs step consists in answering the mere question “who are you”, with the collection of attribute evidence related to the customer being here an individual (documentary or digital, bearing in mind that biophysical, biomechanical and behavioral biometrics do exist).

Validation will then come to make sure that the evidence collected is genuine followed by the verification process whereby there will be a confirmation as to the validated identity indeed relates to the customer undergoing the process.

- Authentication and identity lifecycle management

This part of the ID process could be briefly summarised as “Are you the one you say you are? “.

As stated by the FATF, “the more factors an authentication process employs, the more robust and trustworthy the authentication system is likely to be”. Once the customer has been successfully proofed and enrolled in a digital ID system, the authentication process guarantees to the professional that the person presenting the credential is really the person to whom it belongs.

The common authentication factors can be best summarised as follows:

Lifecycle management merely refers to steps professionals will have to take in response to events occurring to credentials (loss, theft, etc).

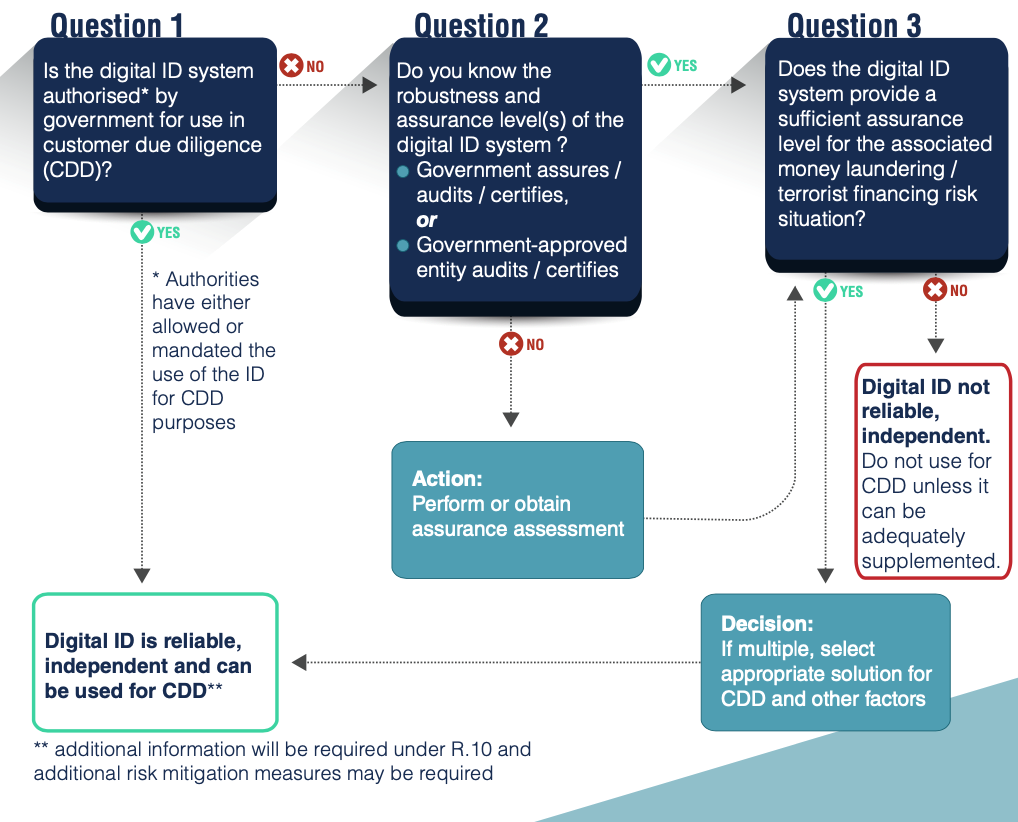

B. Making sure that a Digital ID system is suitable for customer due diligence purposes

Apart from the CSSF guidance on video chat and the fact that the CSSF will eventually be consulted on any digital ID onboarding system used or set-up by a professional, there is no specific Luxembourg guidance on the suitability of a digital ID system which will be used to onboard customers.

Therefore, the FATF illustration below, combined with a risk-based approach, will come handy for professionals to elect the right system and make sure that the latter comes with the right assurance level:

WHAT TO DO?

- Use antifraud and cybersecurity systems/processes to support digital identity proofing and/or authentication to support AML/CFT quest.

- Make sure that the CSSF can obtain the underlying identity information and evidence or digital information needed to identify and verify the identity of your customer/prospect.

2.2 Customers that are legal persons

2.2.1 Identification of customers that are legal persons

“For the purposes of the identification of customers [that are legal persons or legal arrangements], professionals shall gather and register at least the following information:

- name

- legal form;

- address of the registered office and, if different, a principal place of business;

- where appropriate, an official national identification number;

- the name of the directors (dirigeants) (for legal persons) and directors (administrateurs) or persons holding/occupying similar positions (for legal arrangements) and involved in the business relationship with the professional;

- provisions governing the power to bind the legal person or arrangement;

- authorisation to enter into a relationship.”

“The information listed in point 1 above must also be collected and recorded for the initiators, promoters who are behind the launch of an investment fund under the supervision of the CSSF which will be the client of the professional.”

Opening an account for a company in the process of incorporation before completion of the identity verification measures

A professional may open an account for a company in the process of incorporation, insofar as the following conditions are met:

“- the professionals shall identify and verify the identity of the company’s founders pursuant to (…) the Law. They shall receive a declaration from the founders stating that they act, either for their own account or for the account of beneficial owners which they name, and where appropriate, the professionals shall take measures to identify and verify the identity of the beneficial owners pursuant to (…) the Law;

– at the earliest opportunity after the incorporation of the company, the professionals shall complete the measures for the identification and verification of the company’s identity (…) as well as, where applicable, of the beneficial owners (…). The impossibility to verify the identity of the founders, the company and the beneficial owners within the timeframe set by the internal rules shall be subject to an internal report which will be transmitted to the AML/CFT compliance officer for the required purposes;

– sufficient measures shall be put in place so that no exit of assets from the account can be carried out before completing this verification.”

A professional may be held liable if it allows a customer which is a legal person to make use of funds before the identification of that customer to be completed.

It is recommended that professionals refrain, at least until they have received the documents or information required, from activating the accounts of legal persons that have not yet been satisfactorily identified. In such cases, the professional concerned must take the requisite measures, inter alia by blocking the account so as to prevent any outflow of funds.

2.2.2 Measures for the identification and verification of the identity of the proxy/proxies (“mandataire(s)”) of a customer which is a legal person

The proxy (“mandataire”) holds an authority from the legal person empowering the former to act in the latter’s name; the professional must proceed to identify, and to verify the identity of, the proxy or proxies in question, including where the proxy is itself a company (that is to say, a legal person), applying a risk-based approach. The identification and verification of the identity of the statutory representative of a proxy which is a company acting as proxy must also be undertaken.

Only the powers of representation of the person(s) acting on behalf of the client “in the context of the business relationship with the professional” will be subject to verification. Professionals will thus not have to systematically identify and verify the identity of all persons holding a power of attorney on behalf of the legal person client.

The proxy or proxies (“mandataire(s)”) must not be confused with the person or persons appearing on a list of authorised signatories provided by a customer that is a legal person. In practice, professionals are given the names of numerous authorised signatories (either in a printed list or in computerised form). Those persons are neither statutory representatives of the legal person nor its beneficial owners. Thus, they are not subject to the same identification obligations as the proxies (“mandataires”) of a customer that is a legal person.

Accordingly, there is no need to verify the identity of the persons appearing on a list of signatories, but professionals are recommended to register their names, not least for the purposes of “name screening”.

“Professionals shall also take note of the powers of representation of the person(s) acting on behalf of the client within the framework of the business relationship with the professional and shall verify them by means of documents likely to be used as evidence, of which they shall take a copy, if necessary in electronic (digital) form.

“This includes (…) :

- “(…) natural or legal persons authorised to act on behalf of customers pursuant to a mandate;

- persons authorised to represent customers which are legal persons or legal arrangements in the relations with the professional.”

- For companies:

The complete documentation relating to a legal person must be such as to make it possible to trace the logical sequence of appointments and delegations of powers, by reference to the articles of association and the designation of the members of the board and thence to the delegation of power(s) to the persons who bind the company vis-à-vis the professional.

As regards the gathering of information concerning the identity of the executives and directors of companies, professionals must, as a minimum, identify and verify the identity of those executives and directors (even those without signing powers) who are in contact with the credit institution.

Duly adapted procedures should be applied to accounts opened in the name of financial institutions, subject to the obligations in respect of correspondent banks.

- For other legal persons:

The identification procedure should be applied, on a case-by-case basis, in exceptional situations, such as the opening of an account in the name of an association, foundation or trade union.

As regards the delegation of powers, the ABBL recommends that professionals should verify the powers of any person who acts on behalf of the customer, and that they should obtain a document evidencing the capacity of the representative in question.

By way of example:

- for the representative of a company or association: the articles of association of the company or association or a delegation of power(s) in due and proper form;

- for the representative of an undertaking for collective investment: the fund prospectus or equivalent documents enabling the management company to be identified;

- for the statutory representative of a municipality/territorial authority: the instrument of appointment (as the case may be), or the delegation of power(s) to named persons.

Depending on its risk analysis, the professional may provide for a reduction in the identification and verification measures to be taken with regard to the proxy (“mandataire”) in the context of simplified due diligence obligations.

2.2.3 Verification of the identity of a customer that is a legal person

“Identifying the customer and verifying the customer’s identity [must be done] on the basis of documents, data or information obtained from a reliable and independent source, including, where appropriate, the relevant means of electronic identification and trust services provided for in Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions in the internal market (…) or any other secure electronic or remote identification process regulated, recognised, approved or accepted by the relevant national authorities”.

Bank for International Settlements “Sound management of risks related to money laundering”, point 37

“(…) the verification of the identity of customers who are legal persons or other legal arrangements shall be made at least with the following documents of which a copy shall be kept, Where appropriate, in electronic (digital) form:

- the last coordinated or up-to-date articles of incorporation (or an equivalent incorporation document);

- a recent and up-to-date extract from the companies register (registre des sociétés) (or equivalent supporting evidence).”

The professional may use a certificate of incorporation, a certificate of conformity, a company contract, (…) or any other document emanating from an independent and reliable source indicating the name, form and existence of the customer.

“According to the risk assessment, the professionals shall take additional verification measures, such as, for example:

- an examination of the last management report and the last accounts, where appropriate certified by a réviseur d’entreprises agréé (approved statutory auditor);

- verification, after consulting the companies register or any other source of professional data, that the company was not or is not subject to any dissolution, deregistration, bankruptcy or liquidation;

- verification of the information collected from independent and reliable sources such as, among others, public and private databases;

- a visit to the company, if possible, or contact with the company through, among others, registered letter with acknowledgement of receipt.”

The professional may supplement the above-mentioned documents in accordance with its assessment of the attendant risks. It may also, where necessary or appropriate, apply simplified customer due diligence measures where its customer is a legal person (see above, Chapter 5 of Part 2 of this Handbook).

It is possible, in certain circumstances, for legal persons originating from certain countries to obtain extracts from the commercial register by internet (for example in Switzerland, Belgium and the Netherlands). Care should be taken to ensure the reliability of the source providing such documents. Luxembourg Business Registers, an economic interest grouping, makes it possible to get hold of numerous extracts from European business registers, by virtue of its participation in the “European Business Register”.

It is current practice for the identification of a legal person to be based on a recent extract from a business register, that is to say, an extract which is preferably less than 12 months old at the time of the opening of the account.

It is recommended that, when identifying legal persons, a distinction be drawn between companies which are clearly actively engaged in a commercial activity (large commercial groups, listed companies, SMEs) and small-scale companies, in particular those set up to hold assets and/or those which may function as shell companies. The fact that a legal person is well known as such a company may be noted in the file.

Where multiple accounts are opened by one and the same legal person, the professional may rely on the verification of its identity carried out at the time of the first opening of an account, unless essential elements of the identification are likely to have changed (change of company name) or the professional has doubts about the accuracy of the information provided. Where a business relationship has been definitively terminated and a new business relationship is subsequently entered into, the professional must proceed afresh with the identification of the customer and verification of the latter’s identity.

Subsection 2. Identification and verification of the identity of the beneficial owners

1. Definition of the concept of beneficial owner

1.1. Definition of the term “beneficial owner”

The obligation to identify the beneficial owners encompasses the identification of:

(a) the beneficial owners of companies;

(b) the beneficial owners of fiducies and trusts;

(c) the beneficial owners of legal entities such as foundations and legal arrangements similar to fiducies or trusts.

Professionals are obliged to take reasonable measures to discover the identity of the natural person who owns or controls the customer or for whose benefit a transaction is carried out.

“‘Beneficial owner’ (…) shall, in accordance with this Law, mean any natural person(s) who ultimately owns or controls the customer or any natural person(s) on whose behalf a transaction or activity is being conducted. The concept of beneficial owner shall include at least:

a) in the case of corporate entities:

(i) any natural person who ultimately owns or controls a legal entity through direct or indirect ownership of a sufficient percentage of the shares or voting rights or ownership interest in that entity, including through bearer shareholdings, or through control via other means, other than a company listed on a regulated market that is subject to disclosure requirements consistent with European Union law or subject to equivalent international standards which ensure adequate transparency of ownership information.

A shareholding of 25% plus one share or an ownership interest of more than 25% in the customer held by a natural person shall be an indication of direct ownership. A shareholding of 25% plus one share or an ownership interest of more than 25% in the customer held by a corporate entity, which is under the control of a natural person(s), or by multiple corporate entities, which are under the control of the same natural person(s), shall be an indication of indirect ownership;

(ii) if, after having exhausted all possible means and provided there are no grounds for suspicion, no person under point (i) is identified, or if there is any doubt that the person(s) identified are the beneficial owner(s), any natural person who holds the position of senior dirigeant (manager)/ senior managing official;

aa) a direct or indirect right to exercise a dominant influence over the customer by virtue of a contract with the customer or by virtue of a clause in the customer’s articles of association, where the law governing the customer permits it to be subject to such contracts or clauses in the articles of association

bb) the fact that the majority of the members of the administrative, management or supervisory bodies of the client in office during the financial year and the preceding financial year and up to the preparation of the consolidated financial statements were appointed solely as a result of the exercise of voting rights by a natural person;

cc) a direct or indirect power to exercise, or a direct or indirect effective exercise of, dominant influence or control over the customer, including the fact that the customer is under single management with another undertaking

dd) a requirement under the national law of the parent undertaking of the customer to prepare consolidated financial statements and a consolidated annual report;”

b) in the case of fiducies and trusts:

(i) the settlor or settlors;

(ii) the trustee or trustees;

(iii) the protector(s), if any;

(iv) the beneficiaries, or where the individuals benefiting from the legal arrangement or entity have yet to be determined, the class of persons in whose main interest the legal arrangement or entity is set up or operates;

(v) any other natural person exercising ultimate control over the fiducie or trust by means of direct or indirect ownership or by other means;

c) in the case of legal entities such as foundations, and legal arrangements similar to fiducies or trusts, any natural person holding equivalent or similar positions to those referred to in point (b)”,

“identifying the beneficial owner and taking reasonable measures to verify his identity so that the obliged entity is satisfied that it knows who the beneficial owner is, including, as regards legal persons, fiducies, trusts, companies, foundations and similar legal arrangements, taking reasonable measures to understand the ownership and control structure of the customer.”

“The beneficial owner within the meaning of Article 1 (7) of the Act means any natural person who ultimately owns or controls the customer or any natural person for whom a transaction is executed or an activity is performed. This may be the case even if the threshold of ownership or control as set out in Article 1 (7) (a) (i) of the Act is not met.”

In providing for the possibility of an obligation to identify as a beneficial owner a natural person holding less than 25% of the shares, the CSSF Regulation draws attention to the fact that the professional’s approach must not involve merely relying on that 25% participation threshold, since that threshold does not automatically enable the real beneficial owner to be identified in every case. Thus it is possible that a person holding less than 25% may be the beneficial owner where that person exercises in some other way control over the management of a legal entity.

It must also be borne in mind that it may be possible for a professional to adopt differentiated approaches to, on the one hand, the identification of beneficial owners pursuant to the Law and, on the other hand, the obligations to be complied with by companies in accordance with the Law of 13 January 2019 on the register of beneficial owners of companies.

1.2 Definition of “controlling persons” in the context of the automatic exchange of information relating to financial accounts in tax matters

It is important to note that different approaches may be adopted as regards the identification of beneficial owners, depending on whether what is involved are customer due diligence measures pursuant to the Law or similar obligations in tax matters.

Also, the information appearing below cannot be equated with the beneficial owner identification obligations under the Law, and is given only by way of comparison. Moreover, the term “controlling persons” within the meaning of the Law of 18 December 2015 cannot be equated with the term “control” in the case of companies or “ultimate control” in the case of fiducies/trusts within the meaning of the Law.

“The term ‘controlling persons’ means natural persons who exercise control over an entity. In the case of a trust, that term means the settlor(s), the trustee(s), the person(s) charged with supervising the trustee(s), as the case may be, the beneficiary or beneficiaries or the classes of beneficiary, and any other natural person ultimately exercising actual control over the trust; and, in the case of a legal arrangement which is not a trust, the term means persons in an equivalent or analogous situation. The term ‘persons having control’ must be construed in accordance with the Recommendations of the FATF.”

The term “passive non-financial entity” (“NFE”) means, in essence, (1) an NFE, that is to say, any entity which is not a financial institution, (2) which is not an active NFE. An active NFE is any NFE which fulfils the eight relevant criteria laid down by Directive (EU) 2014/107. Amongst those criteria, the most representative one appears necessarily to be that requiring less than 50% of the gross income of the entity concerned to be passive income (dividends, interest, rents, capital gains).

In order to determine the residence of “controlling persons” of a passive NFE for new accounts of entities, “(…) the reporting financial institution may rely on information collected and maintained pursuant to AML/KYC procedures, on the understanding that, for the accounts of pre-existing accounts of entities, the rule is as follows:

“For the purposes of determining the controlling persons of an account holder, a reporting financial institution may rely on information collected and maintained pursuant to AML/KYC procedures” [persons controlling a passive NFE].

“For the purposes of determining whether a controlling person of a passive NFE is a reportable person, a reporting financial institution may rely on:

(i) information collected and maintained pursuant to AML/KYC procedures in the case of a pre-existing entity account held by one of more NFEs with an aggregate account balance or value that does not exceed an amount denominated in euros corresponding to USD 1 000 000 (…)” [Determining the residence of a controlling person of a passive NFE].

As regards the identification of the “controlling person” of a passive NFE account holder, the Law of 18 December 2015 on the automatic exchange of information related to financial accounts in tax matters refers to the identification procedures/information collected in the AML context.

In addition, the “CRS-E” form states, in the annex thereto, that the definition of “controlling person” “(…) corresponds to the term ‘beneficial owner’ described in Recommendation 10 and the Interpretative Note on Recommendation 10 of the FATF”.

The ABBL Guidance regarding the implementation of the OECD Common Reporting Standard also states: “Any individual identified as beneficial owner of the Entity under review under applicable anti-money laundering regulations should therefore qualify as Controlling Person of the said entity for the purpose of the CRS” [see Section VII: Controlling Persons of Passive NFEs].

2. Identification of the beneficial owner(s) in certain specific cases

2.1 Identification of the beneficial owner(s) controlling the company by virtue of thresholds (shares/voting rights/capital)

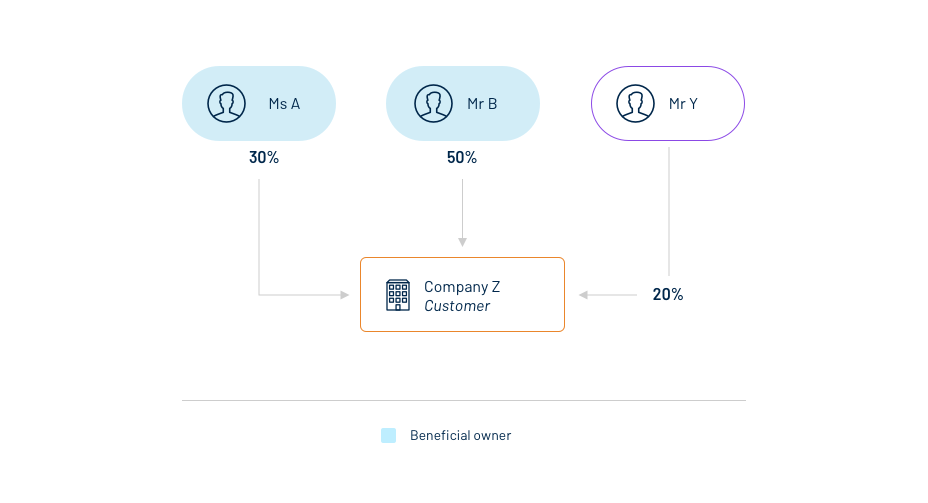

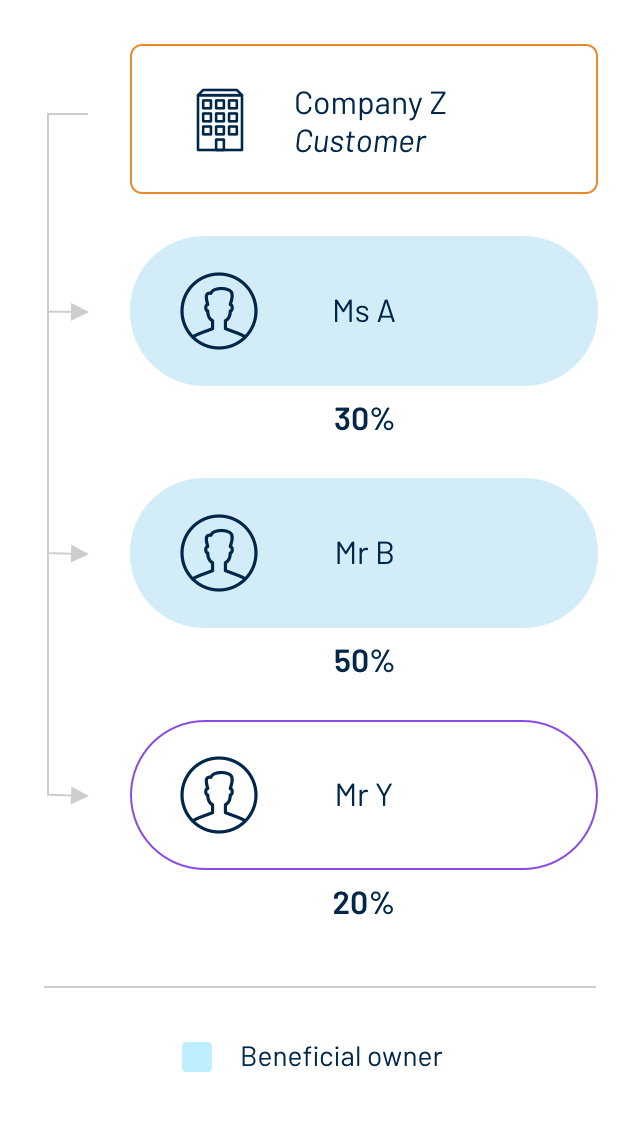

The beneficial owner(s) of a customer that is a legal entity may simply control that entity by virtue of a direct participation comprising over 25% of its capital:

Direct capital holding:

Ms A and Mr B directly hold over 25% of the capital of company Z (units/shares).

They are the beneficial owners of company Z.

As stated by CSSF Regulation No 12-02, a professional may identify the beneficial owner of a legal person, even where the thresholds of participation or control are less than 25%, especially in the context of private banking activities. Thus, the professional must carry out an analysis of the beneficial owner on a case-by-case basis, which may result in it identifying and verifying the identity of Mr Y, even though the latter holds only 20% of the company’s capital.

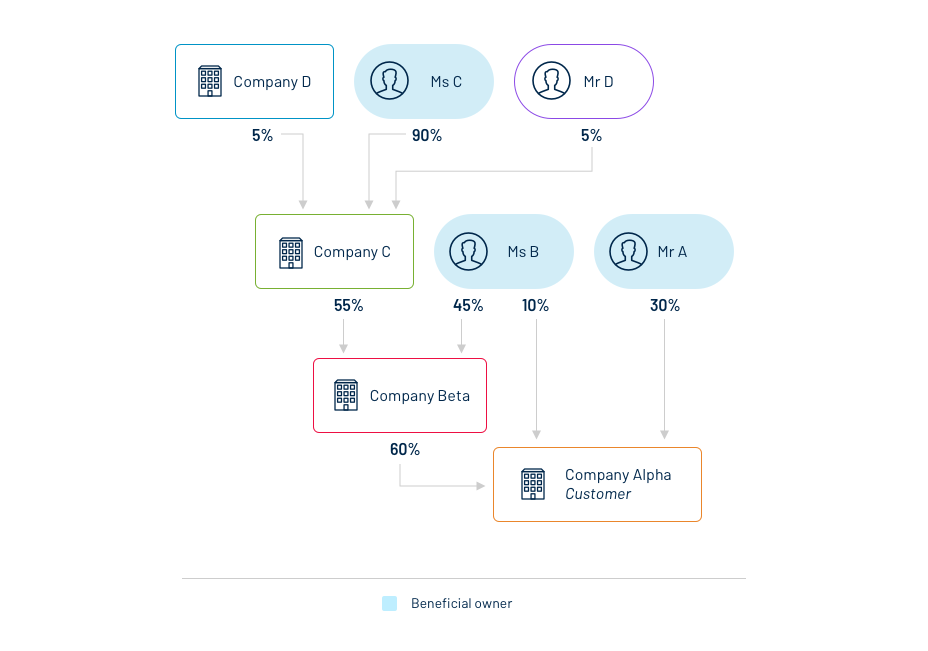

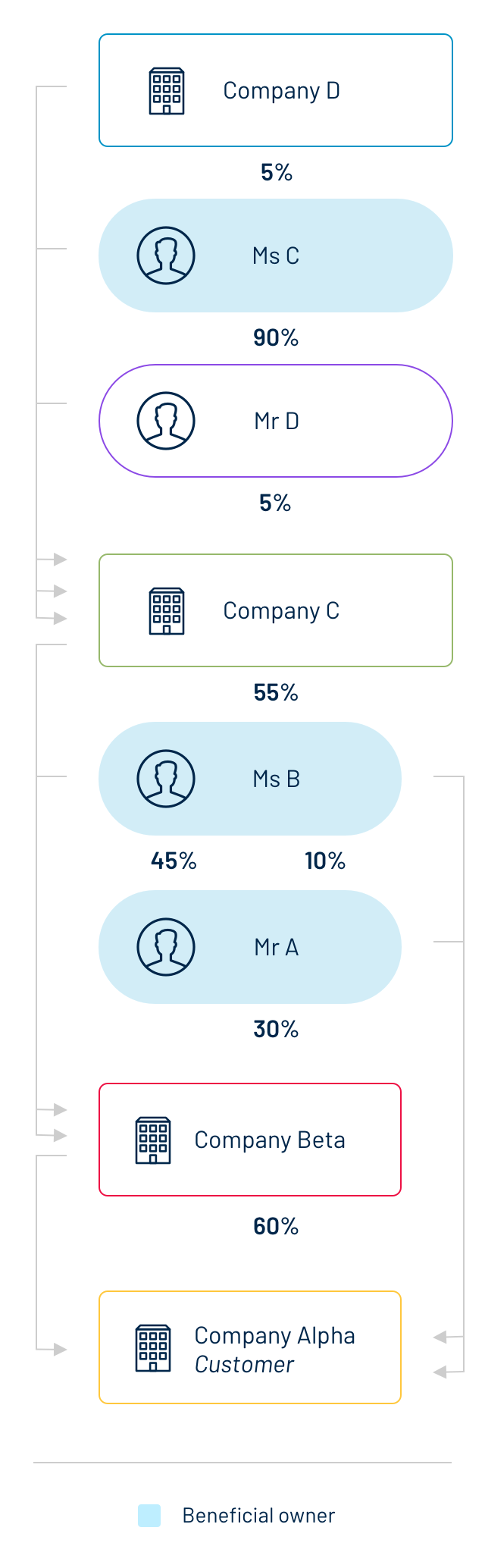

- Control of a legal entity may also result from an indirect holding (or chain of holding) of the capital of that entity:

Direct and indirect holding of the capital:

– Mr A directly holds 30% of the capital of Alpha

– Ms B holds 37% of the capital of Alpha:

27% indirectly via her participation in Beta

(45% of 60%) and

10% directly.

– Ms C indirectly holds 29.7% of the capital of Alpha:

90% of C x 55% of Beta x 60% of Alpha = 29.7%.

In this example, the 25% threshold is exceeded for each beneficial owner.

The methods for calculating the control held by the beneficial owner must invariably take account of the chain of indirect holding.

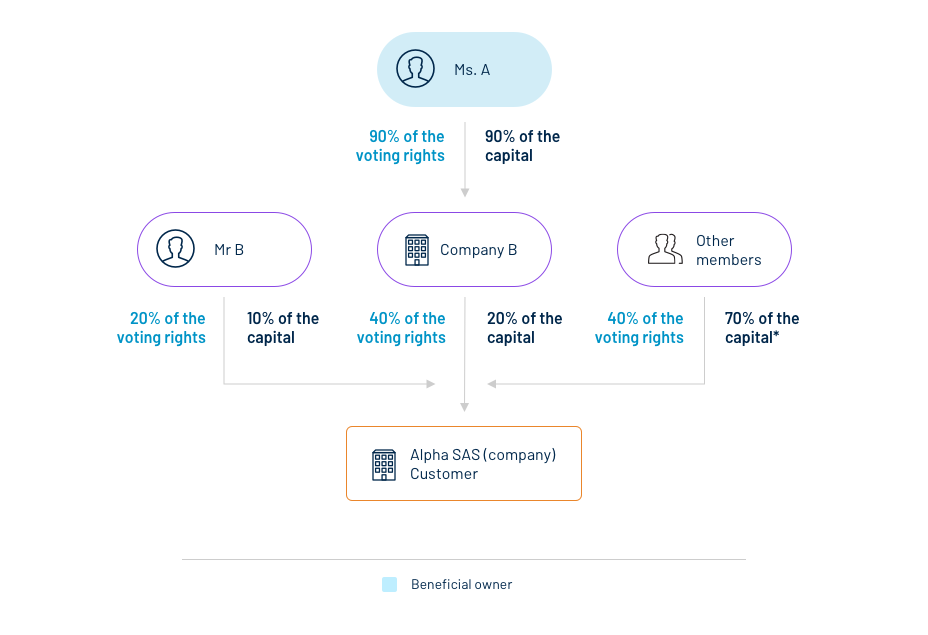

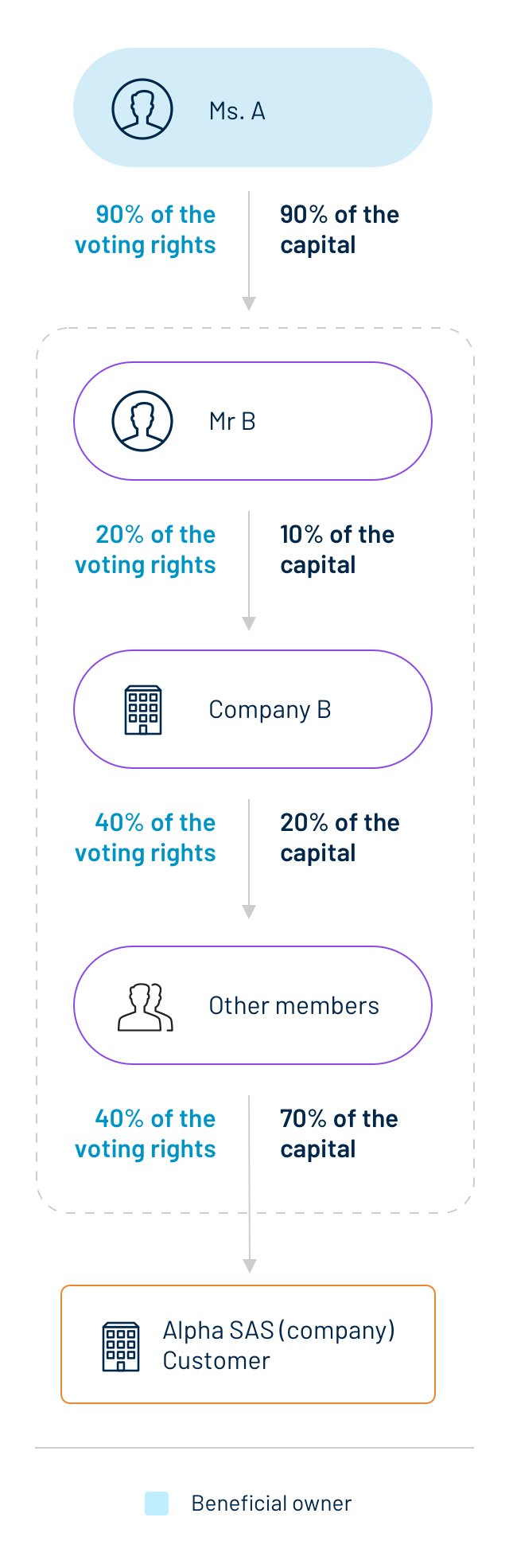

- The beneficial owner may indirectly hold voting rights in the customer:

Indirect holding of voting rights:

Ms A holds over 25% of the voting rights in Company Alpha:

40% x 90% = 36%

(* no other member individually holds more than 25% of the capital or voting rights; there exist no agreements between members)

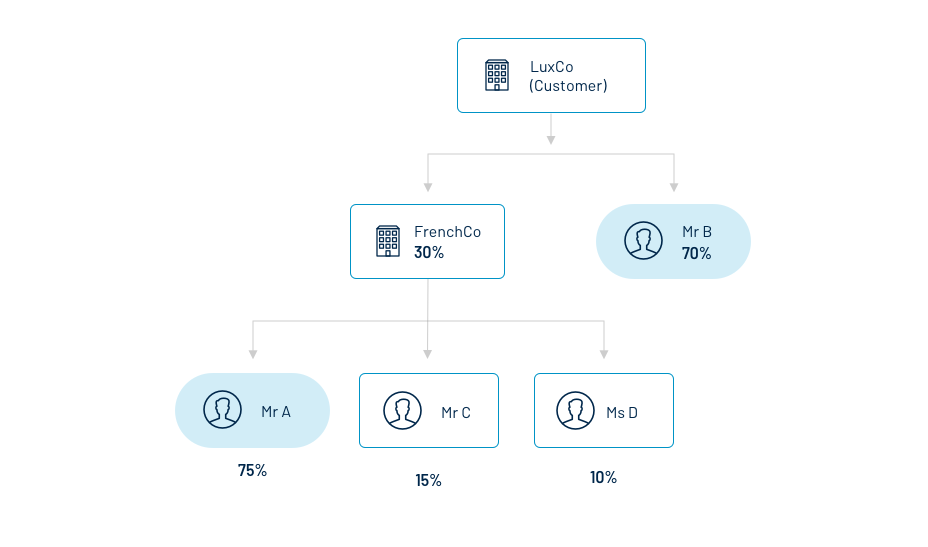

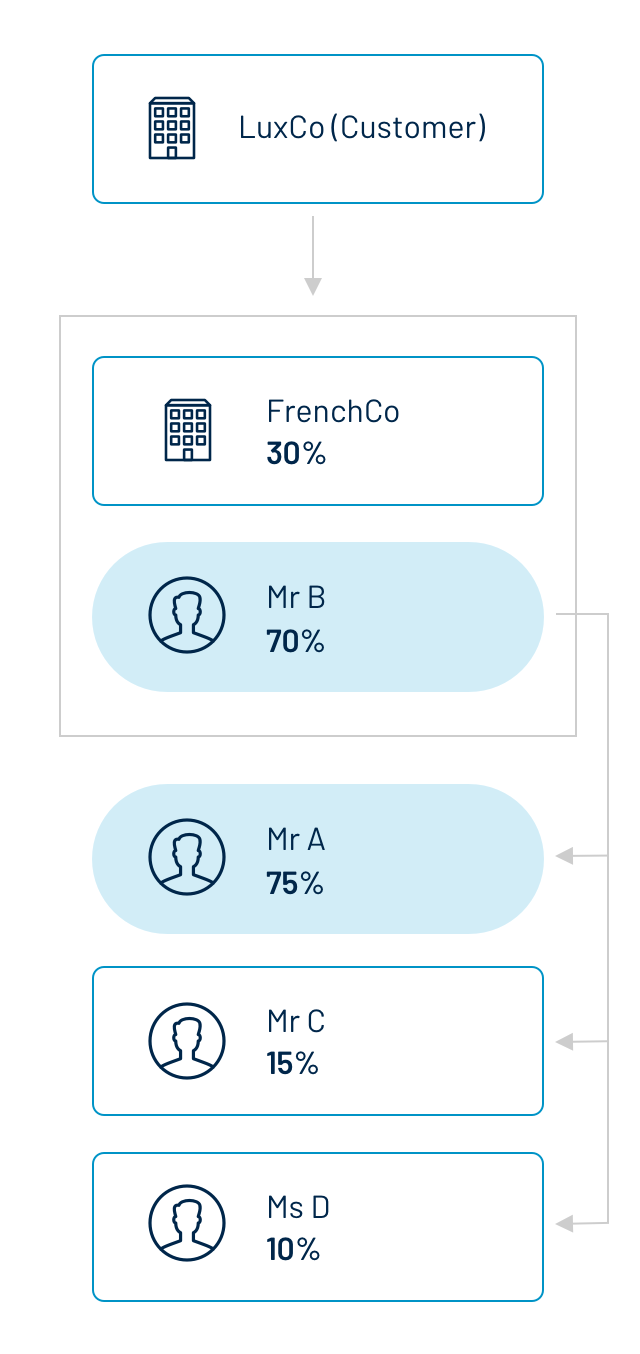

- The beneficial owner holds a majority interest in an entity holding over 25% of the customer company:

Mr A does not hold a weighted interest in LuxCo of more than 25% (75% x 30% = 22,5%), but he holds a majority interest of 75% in FrenchCo, which holds over 25% of the shares/voting rights in LuxCo.

Mr B holds a substantial direct interest in LuxCo. Both of them are the beneficial owners of the customer LuxCo.

2.2 Identification of the beneficial owner(s) controlling the company “through other means”

“Control by other means may be established in accordance with Articles 1711-1 to 1711-3 of the amended law of 10 August 1915 on commercial companies and in accordance with the following criteria:

left-bookmark link=”https://www.cssf.lu/en/Document/law-of-12-november-2004/”]Art. 1, para. (7) of the Act, Points a), ii), 2nd3rd paragraph[/left-bookmark]

aa) a direct or indirect right to exercise a dominant influence over the client by virtue of a contract concluded with the client or by virtue of a clause in the client’s articles of association, where the law governing the client allows it to be subject to such contracts or statutory clauses

bb) the fact that the majority of the members of the administrative, management or supervisory bodies of the client in office during the financial year and the preceding financial year and up to the preparation of the consolidated financial statements were appointed solely as a result of the exercise of voting rights by a natural person;

cc) a direct or indirect power to exercise, or a direct or indirect effective exercise of, dominant influence or control over the customer, including the fact that the customer is under single management with another undertaking

dd) a requirement under the national law of the parent undertaking of the customer to prepare consolidated financial statements and a consolidated annual report;”

The definition of “control by other means” was introduced into Luxembourg law by the law of 25 March 2020.

It may also be useful for the professional to refer to the legal framework of neighbouring Member States to better understand this notion and the situations referred to.

In France, for example, the natural person controlling a company is materialized:

– when he or she de facto determines, by exercising the voting rights that he/she holds, the decisions adopted in general meetings of that company; OR

– when he or she is a member or shareholder of that company and has the power to appoint or remove a majority of the members of the administrative, management or supervisory body of the company in question.

In other words, “control of a company” means the de jure or de facto power to exercise a decisive influence on the appointment of a majority of the directors or managers of the company OR on the way in which it is managed.

Sources:

BRIEFLY:

The right to appoint or remove a majority of the members of the administrative, management or supervisory body of a company OR the right to exercise a dominant/decisive influence over the undertaking pursuant to a contract entered into with that undertaking or to a provision in its memorandum and articles of association, or an agreement entered into with other shareholders or members with a view to controlling the undertaking, constitute “control through other means”.

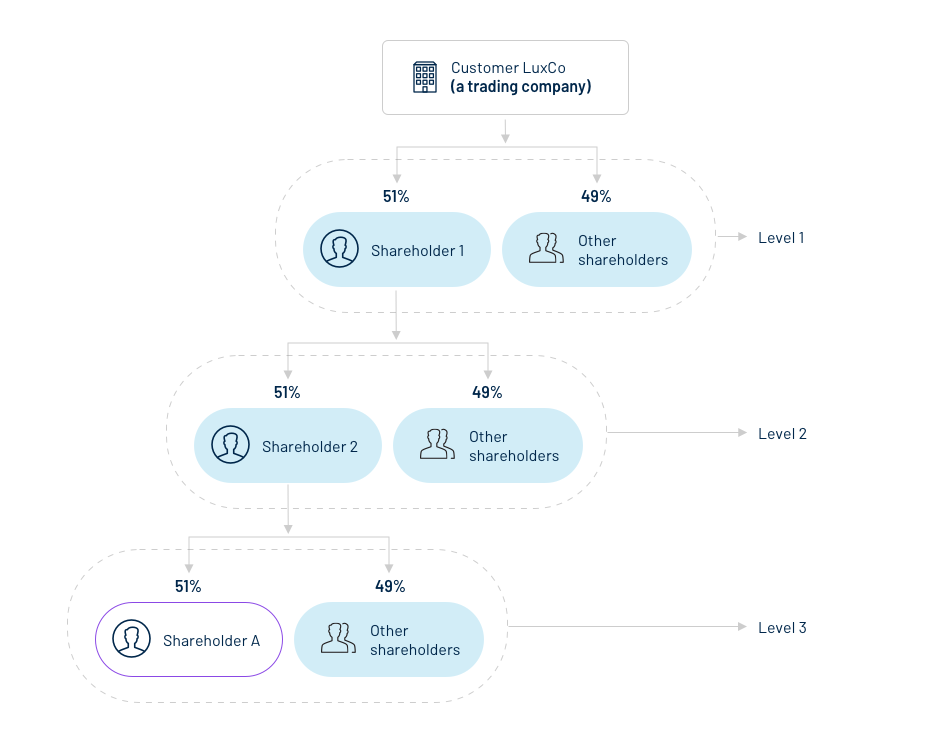

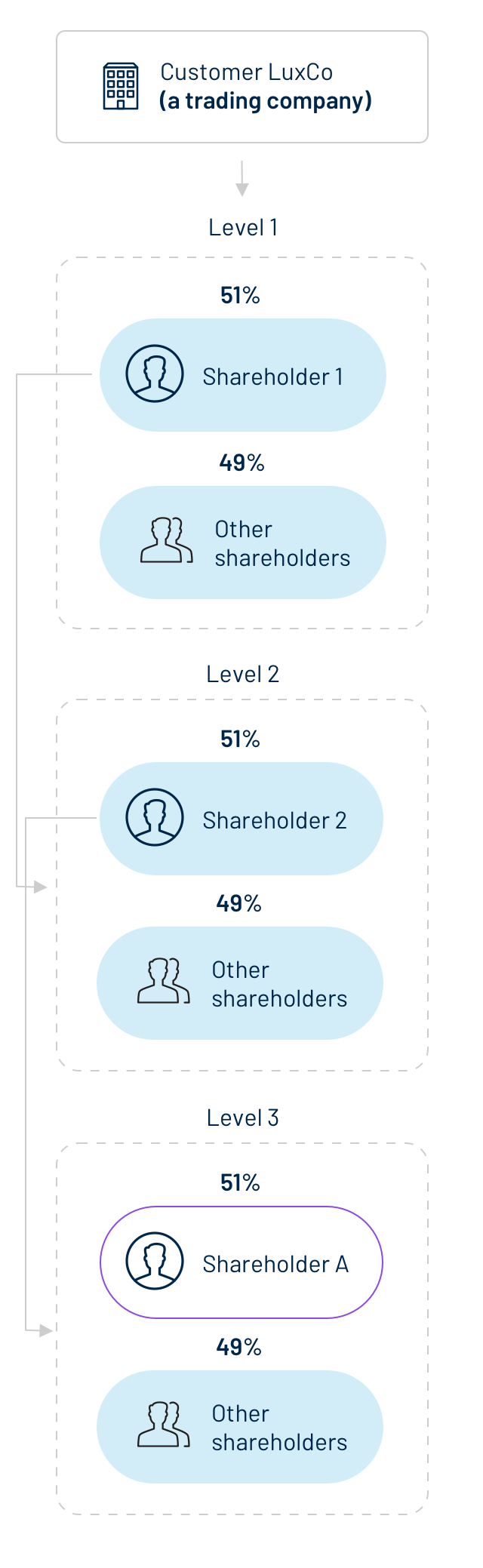

This example shows a chain of shareholders on 3 levels, the assumption being that the reference to “other shareholders” is to disparate groups of shareholders (holding capital amounting to less than 5%).

Shareholder A is the beneficial owner of LuxCo, in that he holds a significant part of the capital of that company, enabling him to exercise a “power of control through other means” over the administrative, management or supervisory bodies or over its general meeting:

– indirect holding of 13.26% of the capital of LuxCo (51% x 51% x 51%), which appears to be significant in light of the holding threshold of the holdings of the groups of “other shareholders”, who hold less than 5% of the capital;

– A is the majority holder of the shares in Shareholder 2, which is itself the majority holder of the shares in Shareholder 1, the majority shareholder of LuxCo.

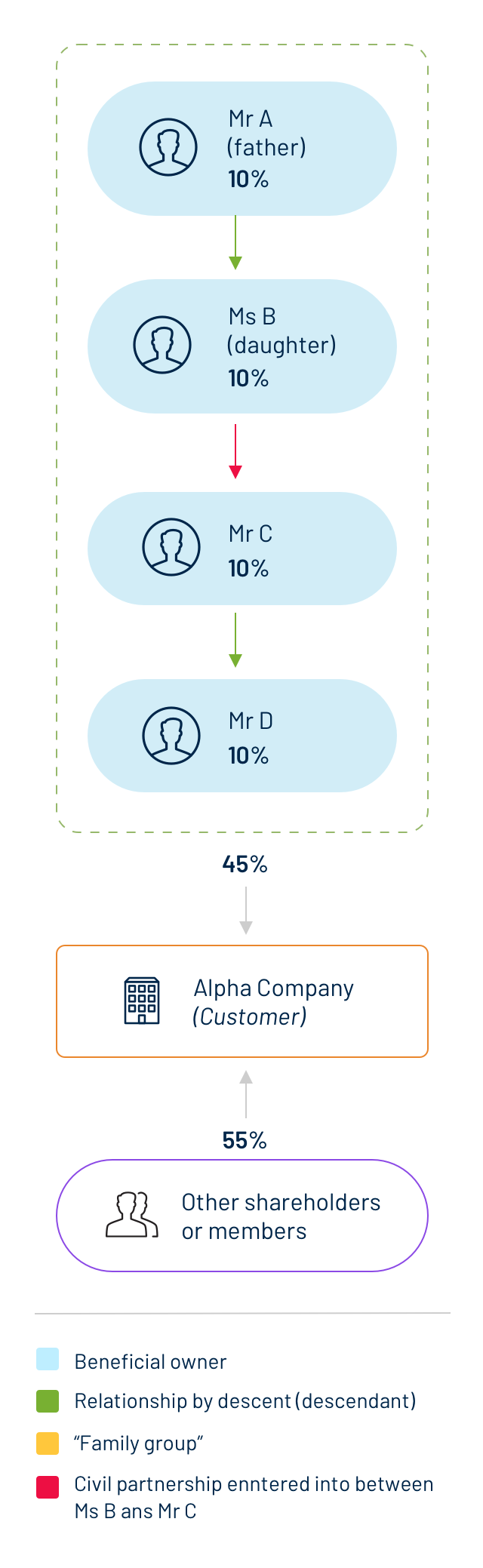

2.2.1 Family group having control of a company

A civil partnership (PACS) is entered into between Ms B and Mr C.

No person within the family group individually holds more than 25% of the capital or voting rights in Company Alpha (the same applies in the case of the “other shareholders or members”, who have not entered into an agreement with each other). But they are acting “in concert”, and are thus able together to determine the decisions adopted in general meetings within the framework of their family relationships.

Mr A, Ms B, Mr C and Mr D are the beneficial owners of the customer Alpha Company: they have control of the customer company “through other means”, since they are members of a family group.

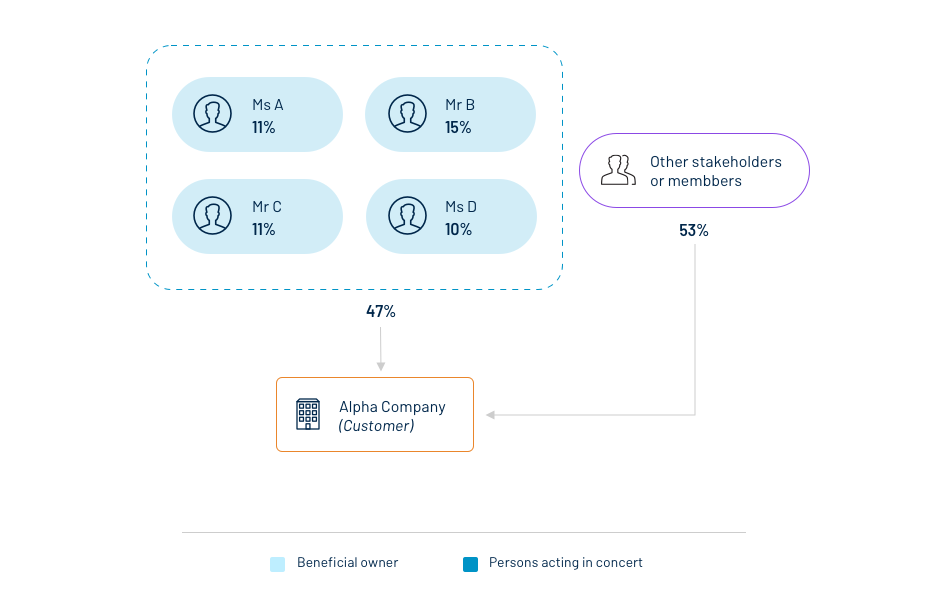

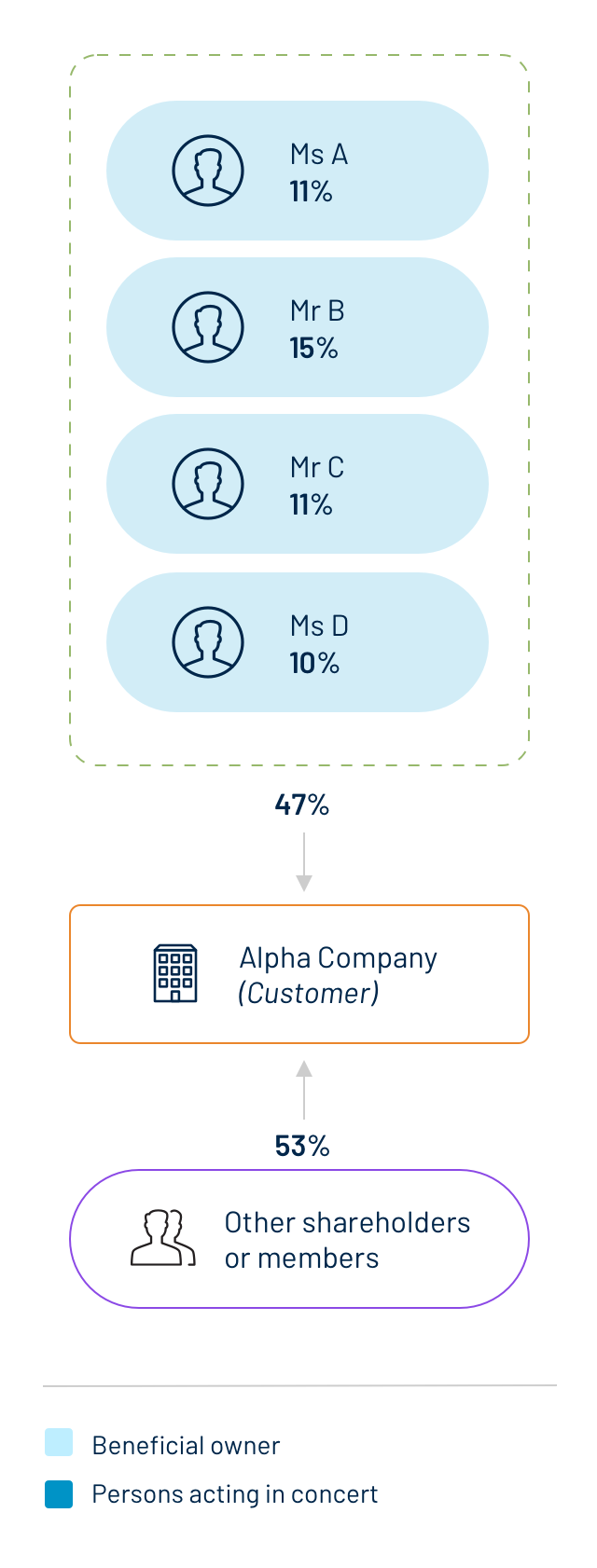

2.2.2 Concerted action between different persons

Concerted action may be defined as follows:

“Persons shall be deemed to be acting in concert where they have entered into an agreement with a view to acquiring, transferring or exercising voting rights in order to pursue a joint policy vis-à-vis a company or to obtain control of that company.”

None of the “other shareholders or members” individually holds more than 25% of the capital or voting rights; they have not entered into an agreement whereby they hold more than 47% of the voting rights.

Ms D and Ms A and Mr B and Mr C are not related to each other. But if they act in concert, they can determine the decisions taken in general meetings. They are the beneficial owners of the customer Alpha Company since they control it “through other means”, being bound by a shareholders’/members’ agreement.

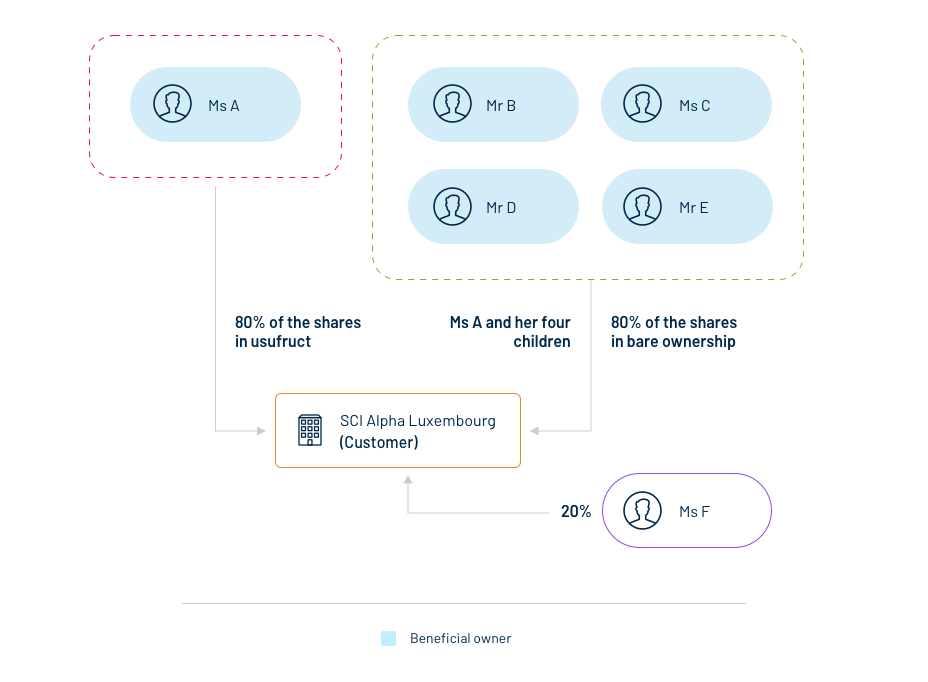

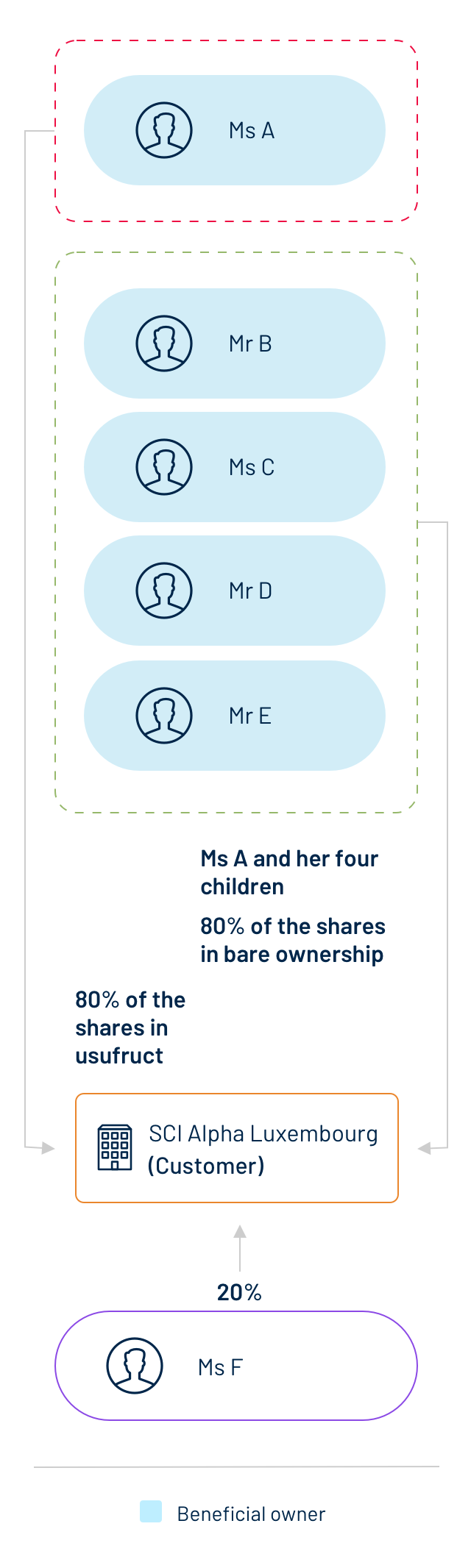

2.2.3 Separation of the attributes of ownership

80% of the shares in the Société Civile Immobilière Alpha (an SCI = a property-holding company) are held by the family of Ms A; the attributes of ownership of the shares have previously been separated: Ms A has a usufructuary interest (life interest) in them and the statutory heirs have an undivided bare ownership (remainder) interest.

Under Article 1852 bis of the Civil Code, the voting rights belong to the holder of the bare ownership (remainder) interest, save as regards decisions concerning the allocation of profits, which are reserved to the holder of the usufructuary interest (unless otherwise provided for by the articles of association of the SCI).

Unless otherwise provided for by the articles of association of the SCI, Ms A, who is not a member of that company, nevertheless determines the allocation of its profits up to 80%. Thus, Ms A is a beneficial owner of the SCI Alpha.

Her statutory heirs, as bare owners (remaindermen), hold 80% of the capital and voting rights in the SCI ; they are therefore beneficial owners (assuming that the articles of association of the SCI do not otherwise provide).

2.3 Identification of the ultimate beneficial owner of a legal person: the “senior dirigeant (manager)/ senior managing official”

here a professional has no grounds for suspicion regarding its customer (a company) and has not been able to determine the beneficial owner(s) of the entity having direct control over the company or indirect control via a chain of holdings, or controlling it “through other means”, or where the professional is uncertain whether the person(s) identified is/are the beneficial owner(s), the professional must treat as being the beneficial owner any natural person who holds the position of senior dirigeant (manager)/ senior managing official.

2.3.1 In the case of companies:

The notion of “senior dirigeant (manager)/ senior managing official” must be understood as referring to those managers of the company who exercise, in practice, the most decisive influence on the management of the company. As a general rule, this will be the Chief Executive Officer (CEO) or the chair of the board of directors (of the company).

In the absence of any statutory definition in Luxembourg law of the notion of “senior dirigeant (manager)/ senior managing official”, professionals may determine as being the beneficial owner(s), on a case-by-case basis, depending on the circumstances and according to the specific characteristics of foreign systems of company law:

(a) the manager(s) of sociétés en nom collectif (commercial partnerships), sociétés en commandite simple (limited partnerships), sociétés à responsabilité limitée (private limited companies), sociétés en commandite par actions (limited partnerships with shares) and sociétés civiles (civil-law partnerships);

(b) the general manager/CEO of sociétés anonymes à conseil d’administration (public limited companies having a board of directors) (one-tier system);

(c) the member of the management board to which the day-to-day management of the company has been delegated, in the case of sociétés anonymes (public limited companies) having a management board and a supervisory council (two-tier system);

(d) the chair or managing director of a société par actions simplifiées (simplified joint-stock company) where the latter has powers of representation analogous to those of the chair which are conferred on him/her by the articles of association.

Where the statutory representatives referred to in points (a) or (d) are legal persons, the beneficial owner(s) will be the natural person(s) who represent those legal persons in law.

CSSF Circular 20/742 specifies that reporting entities will be required to take reasonable steps to verify the identity of the natural person who occupies the position of key manager and to keep records of the steps taken and of any difficulties encountered during the verification process.

Sources:

“(…) the concept of senior managing official/senior dirigeant (manager) is generally to be understood as the management body legally provided for and not just for instance, the chairman of a board of directors. Can also be considered as senior managing official, the person to whom the daily management of the company has been delegated or any other equivalent body according to legal or statutory provisions, in which case only the latter must be registered”.

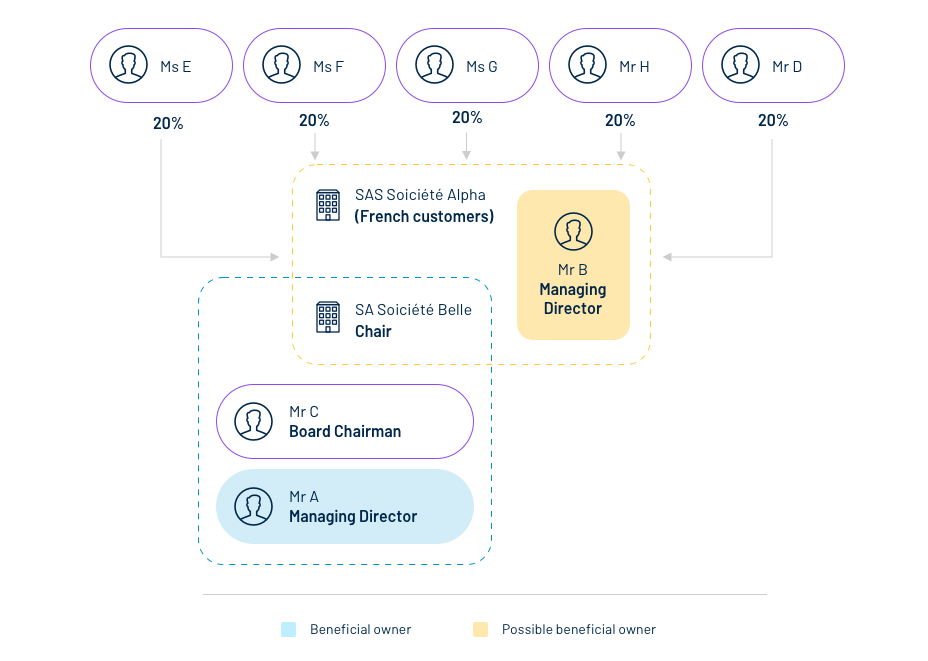

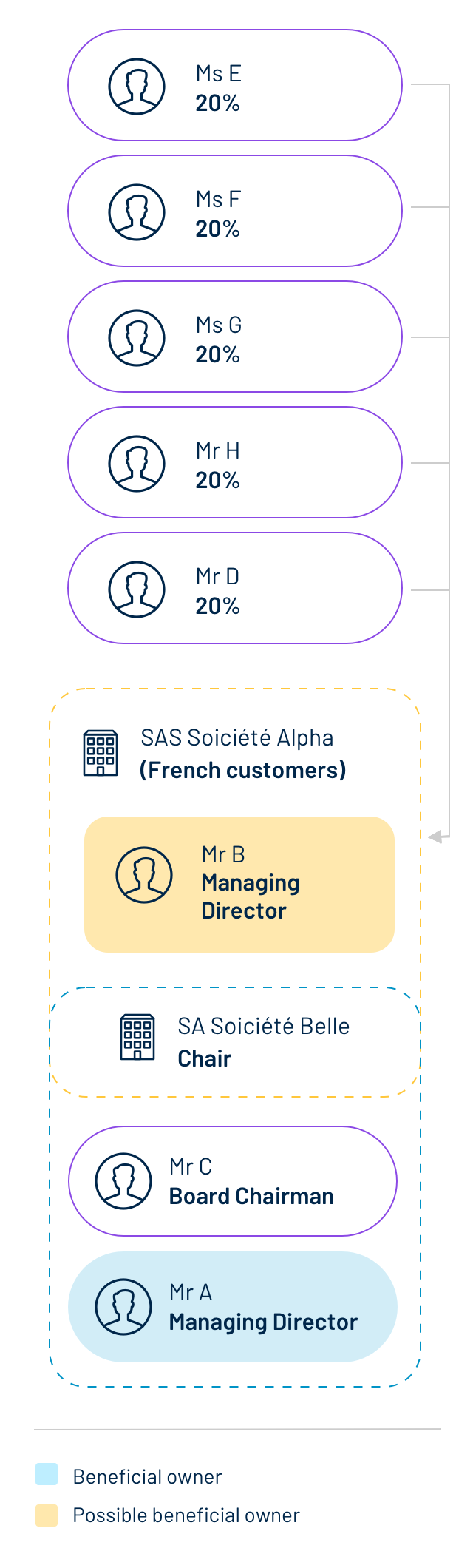

Illustration of a situation where the legal representatives are, by default, the beneficial owners:

It has not been possible to identify any beneficial owner of Alpha SAS, either in terms of the holding of capital/voting rights, or in terms of control through other means.

Accordingly, the legal representatives of Alpha SAS should be identified as its beneficial owners:

- Mr A (Managing Director of the company Belle S.A., which holds the position of Chair of Alpha SAS), since, in French sociétés par actions simplifiées (simplified joint-stock companies), power is exercised by a single person, namely the chair, who may be a natural or a legal person (the sole mandatory management organ);

- possibly, Mr B, if the articles of association of Alpha SAS confer on him executive powers and a power of representation which are the same as those of Belle S.A.

The designation of the “senior dirigeant (manager)/ senior managing official” as the beneficial owner should remain an exceptional measure, and should only be resorted to after all other possible means under the Law have been exhausted (thresholds in respect of direct/indirect holdings; control through other means) to determine the beneficial owner(s) of the customer company.

Depending on the legal form of the customer company, the function/designation of the senior dirigeant (manager)/ senior managing official, as the beneficial owner may well vary.

For the purposes of identifying the “senior dirigeant (manager)/ senior managing official” as the beneficial owner, it is necessary to look first and foremost at the organ responsible for managing the company, charged with the day-to-day management of the entity. Professionals should none the less base their analysis, on a case-by-case basis, on the aspects of the specific business relationship with which they are confronted in each given instance.

- The concept of “legal representative” as applied in the case of a Luxembourg customer company (non-exhaustive example):

Indicative table concerning the “legal representative”

| Legal representative (executive power of the management body) Beneficial owner of “last resort” (senior managing official/ senior dirigeant [manager] ) | Administrative organ | |

|

| In the case of a sociéte en commandite spéciale having the structure of an investment fund: the members of the board, unless specific legal arrangements are set |

(civil-law partnership) | the manager(s) | |

|

| |

(« système moniste ») |

(otherwise, where the managing director is a legal person, the permanent representative charged with execution) | Where the SA is a UCITS (“SICAV”): the members of the board, unless specific legal arrangements are set |

|

(otherwise, in the case of a legal person, its permanent representative) | Where the SA is a UCITS (“SICAV”): : the members of the supervisory council unless specific legal arrangements are set |

| the manager(s) (where appropriate, the managing partner)(“actionnaire commandité”) | In the case of an SA that is a UCITS (“SICAV”): The members of the board, unless specific legal arrangements are set |

As regards “fonds communs de placement” (mutual funds): the legal representatives of the fund’s management company: the members of the Board of Directors, unless specifically agreed otherwise in law, should be considered as the “chief executive officer” (i.e. EC of last resort).

2.3.2 In the case of associations

Not-for-profit associations may be involved in the raising and/or disbursing of funds for charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying-out of other types of good works. Nevertheless, they may possibly be used for less virtuous purposes, and risk being exploited for the purposes of, in particular, terrorist financing rather than pursuing a not-for-profit or laudable aim.

The Ministry of Justice has illustrated some cases where associations/foundations are used for TF purposes in guidelines (“Raising awareness of the voluntary sector of the risks of terrorist financing”).

WHAT TO DO?

The professional’s customer may be an association (whether or not promoting the public interest). In such cases, the professional must adopt a prudent approach and must identify the “beneficial owner of last resort”.

Apart from identifying the beneficial owner of last resort, the professional must without fail ascertain whether the association is being used within a set-up aimed at effectively philanthropic goals or with a view to the optimisation of property assets. It is recommended that information be obtained concerning: the name and address of the organisation and its charitable object, as well as an extract from the business register.

The FATF considers that the natural person exercising control over a legal person is the person who supervises that legal person’s day to day or regular affairs through a senior management position, such as a chief executive officer (CEO), chief financial director (CFO) or chair.